💰 Over the Ask: The Bidding War That Wouldn’t Quit in Wellesley

If you thought the days of bidding wars were over, Wellesley has other ideas.

Between 2023 and 2025, nearly half of all single-family homes sold above their asking price — a statistic that would sound implausible in most markets, but in this zip code, it’s practically muscle memory.

The Numbers Behind the Frenzy

Out of 672 sales since 2023:

322 homes (48%) sold above list price.

291 homes (43%) sold below list.

The average sale-to-list ratio across all deals: 101.7%.

That means, on average, sellers walked away with roughly 1.7% more than their asking price — a quiet but powerful testament to just how deep demand runs in Wellesley’s luxury segment.

At the extremes, one sale fetched 148% of its list price, while the biggest miss closed at just 82% — outliers that illustrate how pricing strategy, not just property, can make or break a deal.

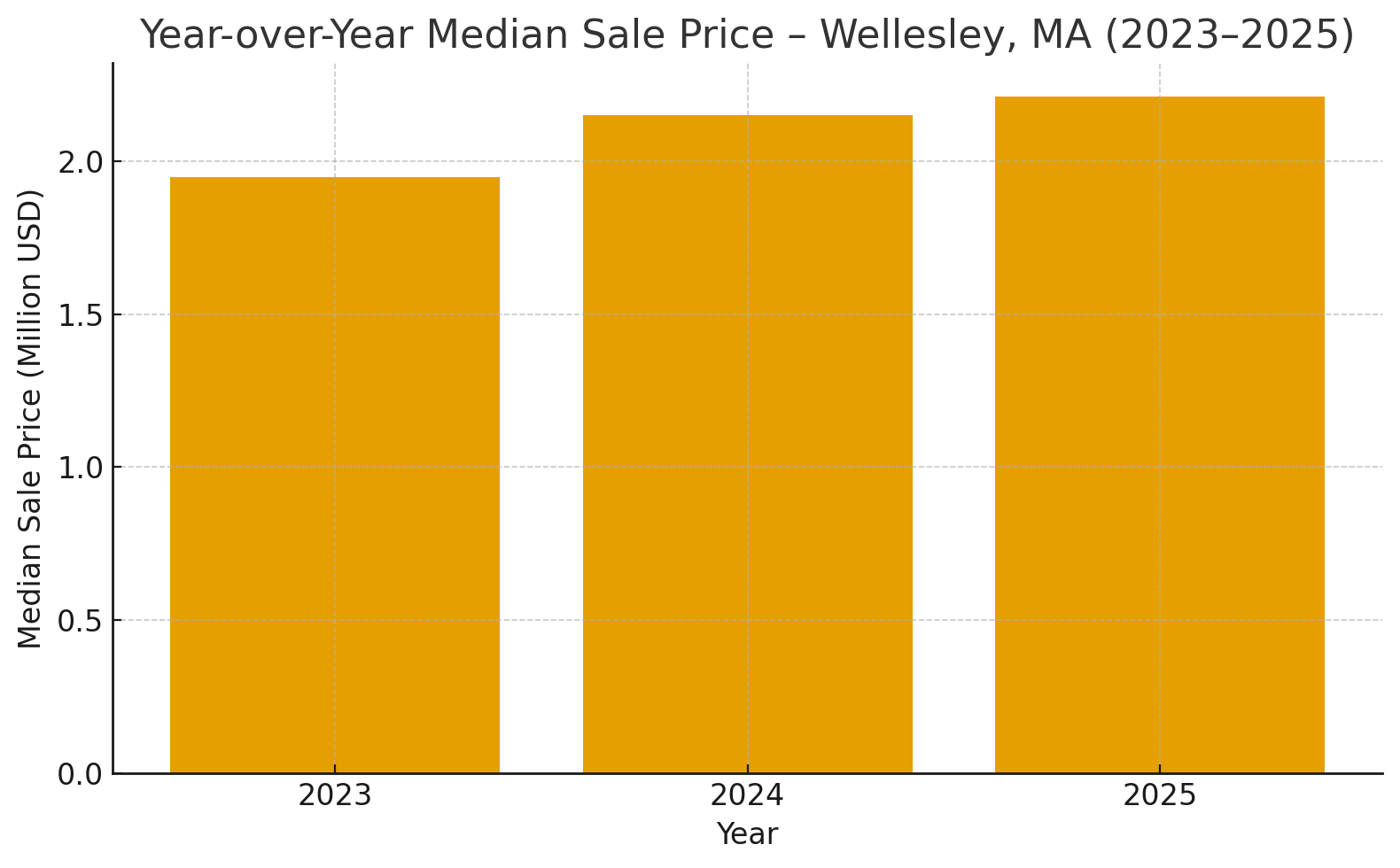

The Yearly Pulse

The data paints a steady narrative:

YearAvg Sale-to-List Ratio% of Homes Sold Over Ask2023102.2%48.9%2024102.0%50.6%2025100.5%43.2%

Even as mortgage rates climbed and headlines declared a housing cooldown, the Wellesley market barely blinked.

The takeaway? Buyers didn’t vanish — they just became more tactical, pouncing when the right property hit the market.

Psychology of the Over-Ask

If markets are about fear and greed, Wellesley operates on a third emotion: FOMO — the fear of missing out on that one perfect house on Cliff Road.

With limited inventory and a consistent pool of buyers (many relocating from Boston or Cambridge), even modest listings can trigger multi-offer showdowns.

A $2.5 million listing that sells for $2.6M isn’t speculative froth — it’s the new equilibrium.

Why It Matters for Sellers

For homeowners, the lesson is simple but nuanced: pricing right still wins.

Overpricing leads to stagnation; underpricing invites a feeding frenzy that often delivers above-market results. The sweet spot is a realistic list price paired with impeccable presentation — think staged, photographed, and timed to hit the spring wave.

The Bigger Picture

Zooming out, the consistency of Wellesley’s over-ask trend tells us something broader about suburban economics post-2020: premium suburbs remain insulated from volatility.

While other regions saw pandemic spikes followed by retractions, Wellesley’s line barely wavered — a suburban blue chip quietly compounding in value.

Final Thought

Even in a higher-rate world, emotion still moves markets. And in Wellesley, emotion is spelled with a dollar sign — and usually, it’s a little higher than the one on the listing sheet.